Bitcoin Miners: Unveiling Their Vital Role in Grid Services.

The angst against Bitcoin Miners from the renewable industry is unwarranted. A FERC tech conference is needed.

Bitcoin mining is highlighting the need to compensate for grid services. Environmental advocates are focused on the negative attributes but don’t acknowledge the positive attributes Bitcoin miners provide. I don’t believe Bitcoin mining is bad for the grid. What it does is highlight the need for flexibility as a grid service that needs to be compensated.

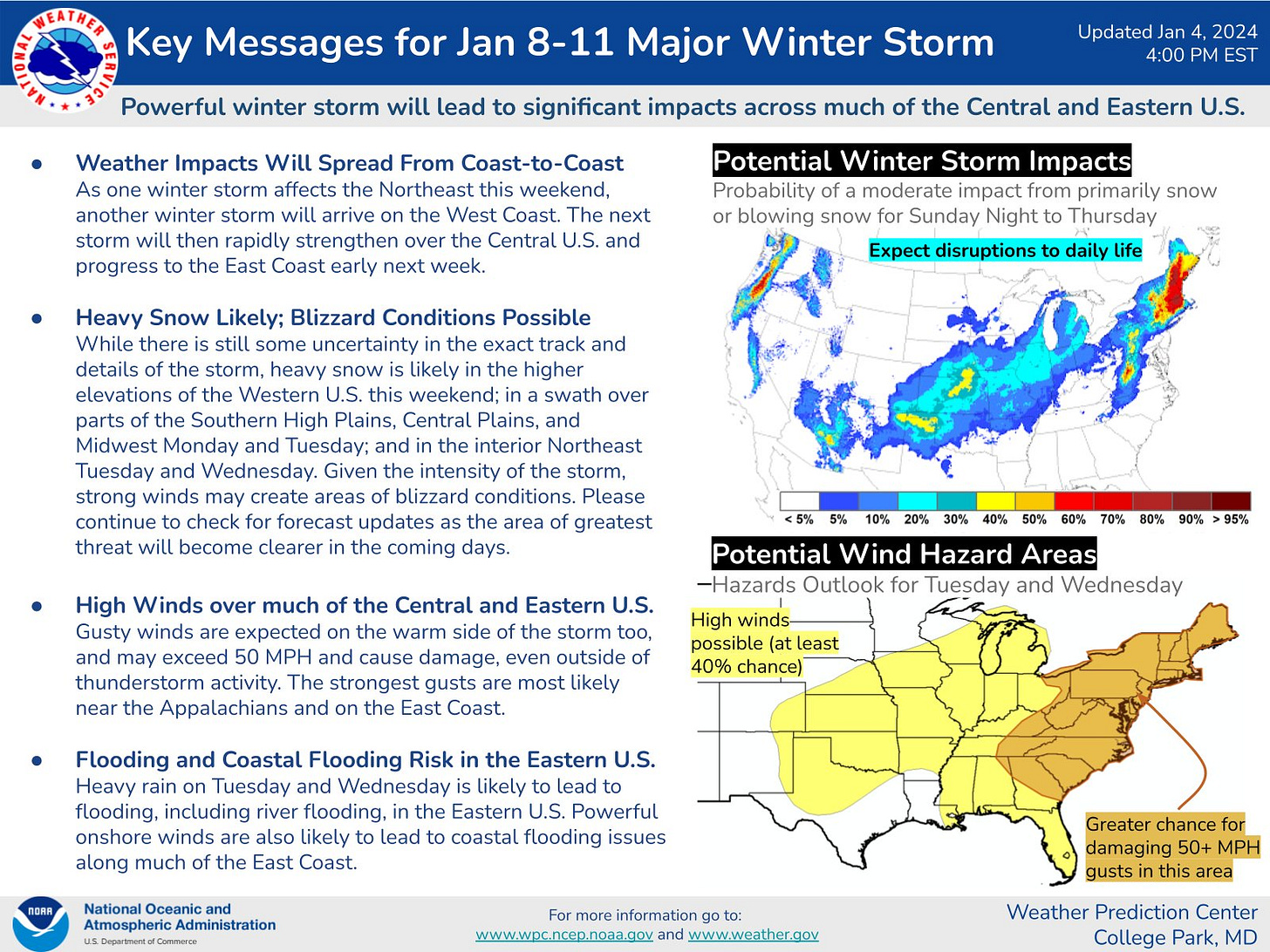

Winter Storm Ember is on its way screams the headline - (Credit https://x.com/SimonMahan/status/1743041063420383464?s=20 )

So many changes came as a result of the last Winter Storm (Elliott in 2022). I hope people in the Northeast don’t lose power due to this latest forecasted storm. These storms are a reminder that we need to compensate large industrial consumers who can reduce their demand when there are grid emergencies like winter storms.

Bitcoin mining is highlighting the need to compensate those who can reduce their demand.

A Net Benefits Test is conducted to determine whether demand side programs are benefiting the grid in markets under the federal jurisdiction. The industry needs either a Net Benefits Test or a variation of this test to determine whether Bitcoin mining is providing flexibility to the grid. We need the Federal Energy Regulatory Commission to open a regulatory proceeding and pursue whether this Net Benefits Test is a good idea for Bitcoin miners. A FERC Tech Conference would be a good step before opening a rulemaking docket.

Yes, bitcoin mining is an energy-intensive process.

In the United States alone, the electricity demand for Bitcoin mining could reach 10,000 MW in the next 5 years, states this article from February 2022. Texas grid operator ERCOT could add 5,000 MW of mining load by the end of 2023 states this November 2021 article. Bitcoin miners consumed 2,100 MW as of March 2023, mentions Reuters, citing the Texas Blockchain Council. So, not quite the estimated demand, but it proves that Texas is the leading state for bitcoin miners.

There is no doubt in my mind that Bitcoin mining is an energy hog. Bitcoin mining is energy-intensive because miners generate tokens using computing power which needs lots of energy.

How much energy does Bitcoin mining need? According to a May 2022 Forbes article, bitcoin uses 707 kilowatt-hours (kWh) per transaction. A website, “The Balance,” states that bitcoin mining uses 1390.5 kWh per transaction, citing Digieconomist as of September 2022. CNET, in July 2022, states, citing the Bitcoin Energy Consumption Index, that Bitcoin mining uses 1,449 kWh per transaction. For comparison, the average residential home consumed 10,500 kWh in 2020, according to the U.S. Energy Information Administration. That EIA number translates into 875 kWh per month. Hence, it is reasonable to conclude that the energy used for one transaction of Bitcoin mining is approximately equal to how much an average residential home consumes in a month.

Environmental concerns with bitcoin mining.

No wonder environmental organizations in the electric utility industry are concerned with bitcoin mining. One of those is the Rocky Mountain Institute. In Jan 2023, RMI was concerned that Bitcoin miners were using fossil energy. But this website cites Bitcoin Mining Council’s Q1 2022 data to show that bitcoin mining is using nearly 60% renewable energy. Even if miners are using renewable energy, they are grabbing lots of it, leaving the rest of the consumers to depend on fossil energy is another concern of the environmental advocates.

There are many news stories about Bitcoin miners tapping hydro energy. Hydropower Owners need to talk to Bitcoin miners states this July 2023 blog on the National Hydropower Association (NHA) website. In a March 2023 blog post, the Hydro Review cites the batcoinz.com website to assert that Bitcoin mining uses 23% of hydro energy. The batcoinz.com pie chart shows that both gas and coal combined provide 44% of energy.

In July 2022, PBS did a news story about the Bitcoin mining backlash in Texas. The residents of Corsicana, Texas, which is 60 miles south of Dallas, were concerned that Riot Blockchain, a Bitcoin miner, was taking advantage of the site’s proximity to a 345-kilovolt transmission line.

The concerns around the Bitcoin mining center are not only around energy but also water usage. Bitcoin mining used more water than New York City in 2022, wrote the Wall Street Journal in December 2023.

Yes, bitcoin mining provides a service to the grid during emergencies.

The Utility Dive article from February 2022 quotes Eric Hittinger, interim chair of the Department of Public Policy at the Rochester Institute of Technology, stating that “crypto does provide some flexibility to electricity grids.” This flexibility comes from the ability of Bitcoin miners to curtail their operations if there is a grid emergency. This ability to curtail is called demand response. There are reliability-based demand response programs and economic-based demand response programs.

A reliability-based demand response programs are triggered during a grid emergency need. An example of a reliability-based demand response is the Special Case Resource program from the New York Independent System Operator or Emergency Response Service at ERCOT. An economic-based demand response programs are triggered whenever there is an economic signal to curtail load. Demand Side Ancillary Service Program at NYISO and Aggregated Load Resource at ERCOT are examples of economic-based demand response programs.

Greenidge Generation, LLC, a vertically integrated bitcoin mining and power generation company with operations in Upstate New York, reduced demand by curtailing all of its bitcoin mining operations during grid emergency conditions in the winter of 2022 at its Dresden, New York facility. In addition to reducing its demand, this bitcoin mining operator provided generation capacity to the NYISO grid, going from start-up mode to full capacity mode in 14 hours, according to the company’s press release from Jan 2022.

Similarly, during Winter Storm Uri in Texas in February 2022, crypto miners reduced demand, stated ERCOT, according to this article. During the August 2023 heatwave, ERCOT paid Bitcoin miner Riot $31.7 Million to reduce demand during the heatwave. Earthjustice, dedicated to litigating environmental issues, is unhappy about crypto-mining in Texas because demand response programs are not offered to residents in Texas but crypto miners, states this September 2023 feature on Earthjustice website.

Recently, during Winter Storm Elliott in Texas in December 2022, Bitcoin Miners who show up as Large Flexible Loads (LFL) in the ERCOT market (chart below) reduced more than 1400 MW during the storm relieving the pressure on the grid.

Econ 101 - when demand increases, market price increases. As soon as the market sent that signal that there was increased demand, Bitcoin miners reduced their demand and reduced the pressure on the system.

See this paper, “Leveraging Bitcoin Miners as Flexible Load Resources for Power System Stability and Efficiency” available here - https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4634256

The paper focuses “on the emergence of Bitcoin mining as an important feature for industrial-scale demand response, making use of miners’ inherent characteristics of interruptibility and swift response to enhance grid flexibility.”

Source - ERCOT

Here is the gap in grid services compensation: A Net Benefits Test is needed for Bitcoin mining load.

The angst around Bitcoin miners using fossil energy is probably warranted because there are no regulations that I am aware of that Bitcoin mining should only use renewable energy. Due to the market dynamics, bitcoin miners are naturally located near cheap energy sources like hydro energy and states where there are incentives for bitcoin miners, like Texas.

But the problem with a state like Texas is that it is outside the Federal Energy Regulatory Commission’s jurisdiction. The Texas grid operator ERCOT reports to the Public Utility Commission of Texas (PUCT), not FERC. As a result, nothing is being done at the FERC level.

FERC rules for compensating demand response resources, like FERC Orders 719 and 745, don’t apply to ERCOT. That’s the issue the industry needs to tackle because the Net Benefits Test in those FERC regulations ensures that demand response is only compensated when it provides a net benefit to the grid, i.e., when the demand curtailed is displacing the need to turn on an expensive gas unit.

Since bringing Texas into FERC jurisdiction is a much bigger lift policy-wise, the industry needs to focus on fair and transparent regulatory policies for bitcoin miners in FERC jurisdictional grid operators like NYISO. A FERC technical conference on the grid benefits of Bitcoin mining will parse out the current market compensation methods such as demand response programs and future market compensation methods needed for the unique role Bitcoin mining provides to the grid.