Here is my experience with a PJM generator retirement. Part II/II

PJM tariff could be improved in multiple ways: 1) non-transmission alternatives evaluation in a generator retirement study, 2) generator replacement tariff, and 3) SATOA tariff.

Hard to argue for a Battery Energy Storage System (BESS) to replace the retiring generator when the PJM tariff does not allow that.

Another option to reduce thermal overload is installing a BESS. But for PJM to direct the transmission utility to install a BESS, it needs tariff rules, which FERC should approve. PJM has no FERC-approved tariff to replace a retiring generator with BESS.

What is the advantage of replacing a retiring generator with BESS? There are multiple advantages, but the primary one is that the BESS does not have to go through the generator interconnection queue. At MISO, PJM, and other grid operators, new generators seeking interconnection to the transmission system must go through the generator interconnection queue, but if a BESS is replacing a retiring generator, it does not enter the queue. That’s the primary advantage – no time spent sitting in the queue waiting to be studied. So, PJM does not have a generator replacement study process.

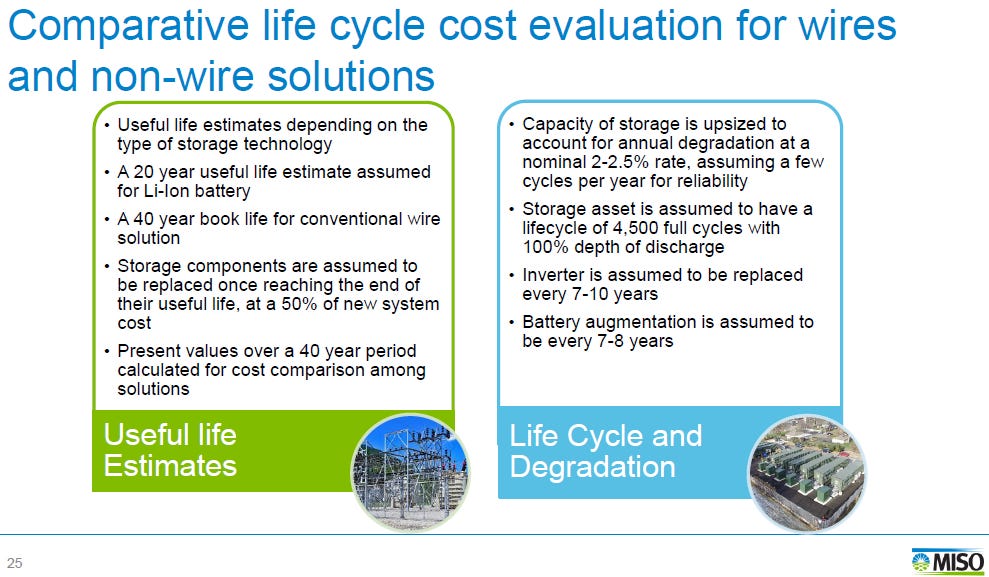

The asset life of a BESS is lower than the asset life of a transmission line.

One issue Transmission utilities keep bringing up when asked to study a BESS as an alternative to a Tx Line rebuild is that they say the life of a BESS is 15-20 years, but the life of a transmission line is 40-60 years. Most utilities lowball the life of BESS and start at 15 years and compare that to the higher end of the spectrum of Tx line life at 60 years. So, utilities show that BESS has a much lower asset life than Tx lines.

On top of that, in my PJM example, I felt that the utility had high O&M costs (33% of the capital costs) for the BESS. When I asked about that, the utility responded that their vendor gave those O&M estimates. Oddly, the Tx utility sought BESS estimates from only one vendor.

I wish State commissions would order Tx utilities to take estimates from at least 3 vendors for non-transmission alternatives.

Source - https://quanta-technology.com/wp-content/uploads/2020/05/20190531-WSPM-Item-03d-ATC-SATOA-review-results349901.pdf

I wish I could say that they are wrong about the asset life, but I also wish to note that battery asset life is dependent on several factors, including how many cycles per day the battery is rated for, the warranty (lower cycles, higher calendar life warranty), what is the temperature rating of the BESS, what are all the applications that the BESS is used for. Higher cycles mean lower asset life. Multiple applications mean lower asset life. But if the BESS is solely used for discharging when there is a thermal overload, it likely has a higher asset life.

The duration and frequency of thermal overloads is unknown.

When making the case for a Tx line, most utilities agree that while the Tx line is needed to address the thermal overloads, they don’t know how long the overloads will last and how frequent they will be. For example, if we knew that a Tx Line is going to be overloaded at x% in 2025 for 100 hours and 2026 for 150 hours, hypothetically, then we could have a BESS that discharges during those 100 hours in 2025 and 150 hours in 2026 negating the need for a Tx line rebuilt.

A counterpoint from the utility could be that there is no commercial battery on the market that can discharge continuously for 100 hours. Fair point. However, how often have thermal overloads continuously occurred for over 100 hours? Today’s battery chemistry technology can easily discharge for 4 hours/6 hours/8 hours.

I am making the point that when a generator retires and a transmission line needs to be rebuilt because of thermal overloads on that Tx line, we could design a less expensive option if we knew how long and how frequent those overloads occur. We don’t know, and neither does the transmission utility. However, the state Commission is required to go along with the transmission utility and approve the Tx line. Why?

Storage As a Transmission Only Asset (SATOA) is a FERC-approved solution for transmission reliability issues. But PJM does not have a tariff.

PJM does not have a tariff for generator replacement, unlike MISO. PJM also does not have a tariff for SATOA, unlike MISO. If a reliability problem due to a generator retirement leads to operational reliability problems, SATOA can address that need. If BESS is solely sitting near the transmission line, when the line is overloaded, the BESS can discharge and remove the overload. But the PJM tariff does not allow that. That’s another problem I saw in my experience.

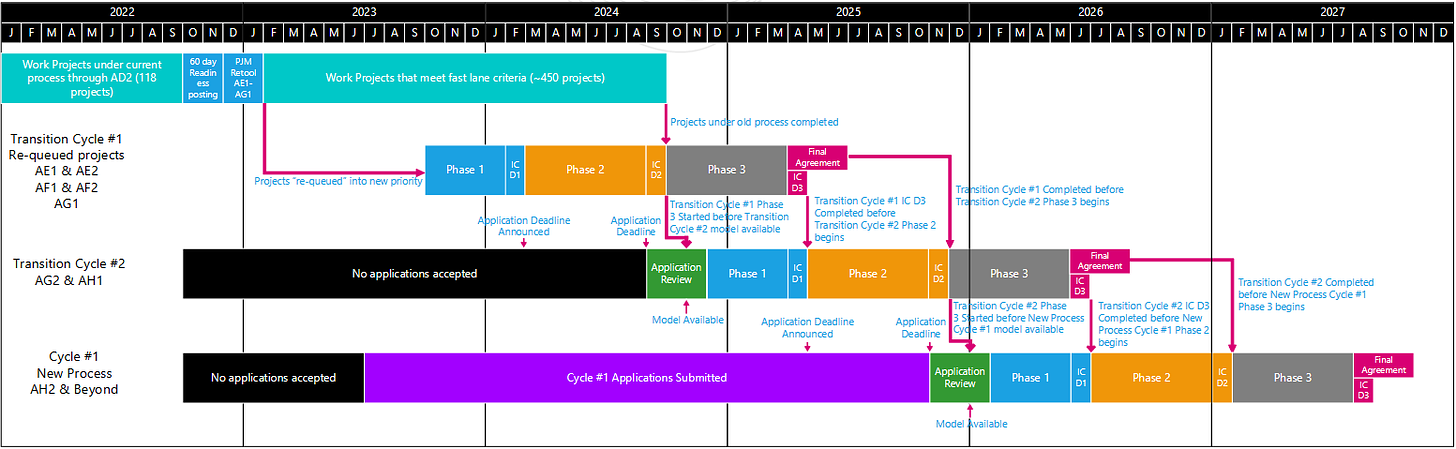

New generator interconnection requests take 2 years, not 6 years, for Generator Interconnection Agreement Execution.

Finally, PJM has moved from studying one generator request at a time to studying multiple generators in a cluster. So, we should expect efficiencies in how PJM studies new generators, right? But transmission utilities say it takes 6 years for PJM to study new generators and make a case for rebuilding the transmission line. On a related note, a backlog of generators is waiting to be studied under the new PJM process. Once the backlog is cleared, new generators take only a year to be studied. Otherwise, PJM can be fined per a rule at FERC that is not implemented yet. This rule is called FERC Order 2023.

Source - https://www.pjm.com/-/media/committees-groups/committees/mrc/2022/20220427/20220427-item-02a-interconnection-process-reform-presentation.ashx

There is no magic bullet to solve the queue backlogs. I get it. But the point is, if a BESS enters the PJM queue after the backlogs are cleared, it takes 1-2 years, not 6 years.

Conclusion

I may not be involved in the Brandon Shores generator retirement, but I have a similar experience with a generator retirement in PJM.

My experience points out that the PJM tariff could be improved in multiple ways: 1) non-transmission alternatives evaluation in a generator retirement study, 2) generator replacement tariff, and 3) SATOA tariff.

The economic regulator, FERC, should mandate DLRs on all existing Tx Lines before the need for rebuilds occurs. The reliability regulator NERC should be explicit in Tx planning standards that BESS and DLRs are viable alternatives to mitigating thermal overloads on Tx Lines. The State Commission where the Tx line is located should order the utility to provide estimates from at least 3 vendors for all possible non-transmission alternatives.