How Capacity Markets Reduce Consumer Costs

Capacity Market provides a signal for how much and where to site the new capacity.

In the ever-evolving landscape of the electricity market, ensuring grid reliability and meeting peak demand are paramount. One of the mechanisms designed to achieve this is the capacity market. This blog post explores how capacity markets function and make a compelling case for how they reduce consumer costs.

Read my latest posts on MISO and PJM’s capacity auctions here -

https://www.renewableenergyworld.com/solar/utility-scale/prices-remain-reasonable-at-miso-2024-capacity-auction-except-in-one-zone/

https://www.renewableenergyworld.com/policy-regulation/pjms-capacity-auction-results-show-the-need-for-more-demand-response/

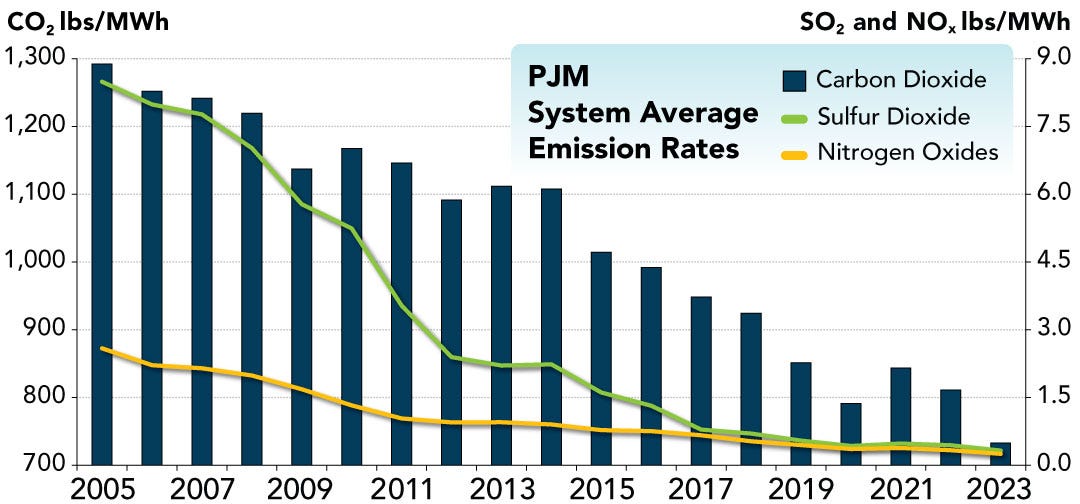

See for yourself with the chart below - capacity markets work! Average Emissions are down with PJM’s capacity markets.

Source - PJM

But that success (if you think reductions in emissions is good) does not stop informed stakeholders (even sitting FERC Commissioners - see “the capacity markets are not all right”) to question the need for capacity markets. Because ERCOT in Texas, California ISO, Southwest Power Pool - don’t have capacity markets.

But, whenever a capacity market (either in PJM or at MISO - they are not equal but let’s just go with the flow for now) results in higher prices - all hell breaks loose.

Read this blog on the latest capacity prices in PJM - https://www.nrdc.org/bio/claire-lang-ree/pjms-capacity-auction-real-story

But factor in what PJM is saying about new generators not getting built even though PJM has done its job - https://insidelines.pjm.com/interconnection-reform-is-working-but-will-new-generation-actually-get-built/

Introduction to Capacity Markets

Capacity markets are mechanisms established to ensure that there is enough electricity supply to meet future peak demand. They function by providing payments to electricity providers for maintaining sufficient capacity to meet peak periods. The primary purpose of these markets is to ensure grid reliability and prevent blackouts by incentivizing the availability of resources when they are needed most. By providing a financial signal to attract investment in new capacity and retain existing capacity, capacity markets play a crucial role in the energy landscape.

Source - PJM

How Capacity Markets Work

In a capacity market, electricity providers receive payments for maintaining the capability to supply electricity during peak demand periods. These payments are determined through competitive auctions held well in advance of the delivery year. For instance, PJM, one of the largest capacity markets, conducts forward-looking auctions three years in advance to secure capacity commitments. This advance procurement ensures that sufficient resources are available to meet peak demand, thus enhancing grid reliability.

Capacity Markets are covered extensively in the “Modern Electricity Systems” book also -

Benefits of Capacity Markets

Reliability: Capacity markets ensure there is enough capacity to meet peak demand, significantly reducing the risk of blackouts. This reliability is crucial for both consumers and businesses, ensuring that electricity supply remains stable and predictable.

Incentives for Investment: By providing financial incentives, capacity markets encourage generators to maintain and invest in capacity. This investment is vital for the continued development and maintenance of the electricity infrastructure.

Market Efficiency: Capacity markets enhance market efficiency by sending clear price signals for resource adequacy. These signals help in the optimal allocation of resources, ensuring that the electricity supply meets demand in the most cost-effective manner.

Case Study: PJM Capacity Market

PJM operates one of the most sophisticated capacity markets through its Reliability Pricing Model (RPM). PJM's capacity market has attracted new investments and ensured a diverse supply mix. By conducting forward-looking auctions three years in advance, PJM secures capacity commitments from a variety of resources, including traditional power plants, demand response, and energy efficiency. This approach has not only enhanced grid reliability but also encouraged significant investment in new generation and maintenance of existing resources.

Source - PJM

Comparison of Capacity Markets

Different capacity markets in the U.S. operate with slight variations, but all aim to ensure grid reliability and resource adequacy. For example:

ISO New England (ISO-NE) operates a Forward Capacity Market (FCM) that holds forward capacity auctions three years in advance. This competitive auction process ensures the lowest cost resources are selected.

NYISO combines auctions and bilateral contracts to maintain resource adequacy, ensuring the reliable operation of New York’s electric grid.

MISO offers a unique voluntary participation capacity market, allowing flexibility for participants to meet capacity obligations through self-supply, bilateral contracts, or the auction.

Source - FERC

Challenges and Solutions

While capacity markets offer significant benefits, they also face challenges such as complex auction designs, regulatory hurdles, and the integration of intermittent renewable energy sources. Addressing these challenges requires market reforms, technological advancements, and regulatory adaptations.

Conclusion

Capacity markets play an essential role in the electricity market by ensuring there is enough capacity to meet peak demand, reducing the risk of blackouts, and providing financial incentives for investment in capacity. By enhancing market efficiency and ensuring grid reliability, capacity markets ultimately reduce costs for consumers. As the energy landscape continues to evolve, capacity markets will remain a critical component in ensuring a stable and cost-effective electricity supply.

By understanding and supporting the role of capacity markets, stakeholders can help drive the development of a more reliable and efficient energy infrastructure, benefiting consumers and the economy at large.

End note - NYISO started engaging stakeholders on potentially changing its zones in the capacity market. I had listened to the Aug 29, Installed Capacity WG meeting. I will blog about this topic soon!