PJM, Google and Tapestry - will it solve the generator interconnection queue puzzle?

An AI driven transmission planning - may solve the generator queue problem but create or not solve the current problems in planning.

Ever since PJM announced that it is collaborating with Google and Tapestry, I was curious what this announcement is about and if this will lead to something tangible like PJM solving the generator interconnection queue puzzle.

It makes sense for PJM to partner with Google because if Google can solve PJM’s problem with AI, then, arguably Google can solve other grid operators in the same boat. However, it is too soon to tell because PJM serves 67+ Million people in the Mid Atlantic and as a result has 88,333 miles of transmission lines, 182 GWs of capacity and spans 13 states + DC. An AI-driven transmission planning may solve the generator queue problem but create or not solve the current problems in planning.

PJM’s announcement

“This collaboration with Google and Tapestry complements PJM’s ongoing efforts to automate its planning processes as it implements the reformed interconnection process that began in July 2023. PJM will process the remaining 67 GW of projects (out of approximately 200 GW) in the transition phase this year and next, and initiate its new Cycle process in early 2026. PJM also recently announced the Reliability Resource Initiative, which will allow expedited entry of selected projects in the transition phase.” Source: PJM.

But there are still several questions unanswered at this time for me to understand what this all entails and if we are going to see some results in this multi-year effort and where exactly we would see results. There are 3 main areas that I could see Tapestry initially focus with PJM:

Power Flow Modeling

Making power flow modeling visible

AI based transmission planning.

Let’s take these one at a time.

Power Flow Model Building and Solving is Complex.

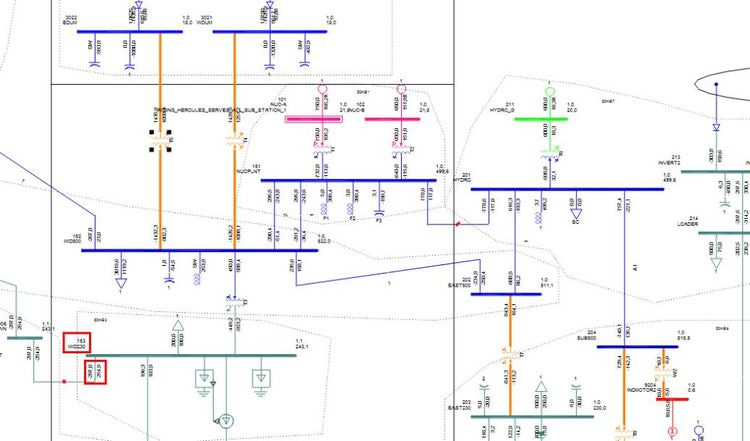

Earlier in my career, I was spending more than 2 weeks on solving one single power flow model. Sometimes it took more than 4 weeks. Solving a power flow model is a delicate process, at least based on my past experience. You should know which bus is the slack bus, the Pgen and Pmax (Qgen/Qmax) values, how much is flowing on the tie lines (Tx lines that connect one region to another), and what the Net Scheduled Interchange is for a Balancing Authority like PJM. Solving a summer peak model is difficult but solving shoulder-peak cases are also complex because there is not enough load in a Spring/Fall case.

Would Tapestry help PJM with model building, developing different power flow cases and solve the model? Model building is the first step in the power flow analysis. See chart below from MISO’s presentation on Pearl Street’s SUGAR model, which MISO is using in the generator interconnection process.

Source: MISO

Because unlike a production cost model like PROMOD, power flow models are a snapshot in time. Power flow cases are like a picture, production cost models are like a movie. Transmission planners and generator interconnection studies are typically run on power flow models not production cost models.

If PJM is building the case for economic transmission, then, production cost models are run. Market Efficiency Projects are built on PROMOD models, but Baseline projects including Supplemental Projects are studied using power flow models.

I gather that Tapestry is going to help PJM solve the power flow with increased amounts of renewable generation. At least that’s what I assume Tapestry is expected to do, based on its experience in Chile, especially given how congested PJM’s generator interconnection queue is and the fact that PJM is working to clear old projects even as new ones continue to enter the queue under the new process. So, one problem that Tapestry could solve for PJM using AI would be to predict where power would flow if 67 GW of projects were accepted.

Will Tapestry model be transparent?

A benefit of Siemens PSS®E power flow model is, it is well established and almost a de facto standard for transmission planning in the Eastern Interconnection. They use GE Vernova Power Flow (formerly PSLF) models for planning on the Western Interconnection. I believe Texas also uses PSS®E mostly. In each of these models, renewable generators like wind, solar have a specific model that the software needs to understand the characteristics of new generators.

Source: Siemens

But I am not sure how Tapestry handles PSS®E or GE Power Flow models. Would someone be able to generate a PSS®E raw case (or the equivalent GE Power Flow case) from Tapestry? My main point here is, currently the engineers at PJM Transmission Owner (TOs) and other stakeholders have the capability to shadow PJM’s generator interconnection engineering studies. Will they have the same ability with Tapestry in future or will that be a black box? The impact of a renewable generator on an existing line determines the cost share of the developer. I am convinced that AI can help speed up interconnecting generators but not yet convinced whether it will be transparent because AI can make mistakes.

Model building errors delay generator interconnection studies frequently. If Tapestry makes an error, will PJM staff catch it in time before releasing the results? I don’t know. Will Tapestry know the difference between a behind the meter generation and load? Because that could mean a difference on whether transmission needs to be built to accommodate the load or if behind the meter generation exists to meet the customer load.

How are microgrids handled in Tapestry? Will Tapestry know if the MG has the capability to intentionally island and for how long?

If AI can solve Transmission Planning or help, that is great. But, will it?

To identify the transmission to interconnect new generators, Tapestry must move from generator interconnection into transmission planning world. What types and what kinds of transmission does PJM Board need to approve to interconnect that 67 GW of queued projects? Tapestry might come up with quick fixes but it takes time to build transmission. I don’t know how Tapestry can solve that problem for PJM or PJM Transmission Owners.

Would Tapestry tell PJM how to sequence planned transmission projects to get most queued projects built? That would be of immense help for PJM assuming the TOs are on-board. What about competitive transmission? Would Tapestry show only projects to be built by the incumbents or would it allow projects to be bid competitively?

I could foresee a lot of angst among PJM TOs if Tapestry hypothetically showed top 10 projects to build and all of them are 345 kV and above, which by FERC Order 1000 requirements must be competitively bid. I don’t know if Tapestry faced this challenge in Chile, which is cited as a success story for Tapestry on its website.

Similarly, I am curious what would PJM do if Tapestry indicated an inter-regional project that benefited MISO and PJM? For example, if Tapestry identified a 345 kV line to Duke Energy Indiana, which is MISO TO, would be most beneficial to PJM, would PJM include that line in PJM’s RTEP? Or, would PJM say, “this is a cross-border project, let’s focus first on regional transmission projects”.

Conclusion

There are a lot of questions at this initial stage on what Tapestry can and cannot do for PJM. It takes time to resolve some of these questions. But PJM, Google and Tapestry have hit upon a worthwhile journey at the right time. The devil is in the details and the details in this case might be a couple of years away.