PJM’s CIFP process for Large Load Additions takes a turn.

A good turn or a bad turn, I cannot tell yet.

CIFP stands for Critical Issues Fast Path stakeholder process. This CIFP process enables PJM to engage stakeholders in a focused 2–3-month effort as opposed to the regular 12-18-month process. PJM has initiated the CIFP process for large load additions, as per the PJM Board’s letter. All of that is now old news, since PJM is knee-deep in stage 2 of this CIFP process. There are four stages to this CIFP process. We already passed Stage 1, which is the initial proposal stage. PJM had first proposed a mandatory Non Capacity Backed Load (NCBL) concept at stage 1, which it has backed out of in stage 2.

Solution options to address the resource adequacy challenges created by large load additions (LLA) are discussed at stage 2. Those options are packed together in stage 3, and stage 4 is for voting. After stage 4, PJM legal staff takes the pen to the paper, and we won’t see anything until PJM files its proposal with FERC. PJM anticipates filing this proposal with FERC by the end of this year. Another way to remember this CIFP process is that PJM started after Labor Day and will finalize the proposal before Thanksgiving, then file it at FERC before Christmas.

Load Forecast Changes

I already mentioned that PJM moved away from its mandatory Non Capacity Backed Load (NCBL) concept. But PJM kept it voluntary in this latest proposal. More about that later. However, first, PJM proposes that the state approve load forecasting changes as part of this CIFP LLA proposal.

PJM does its own load forecasting. PJM’s Load Analysis Subcommittee is in charge of receiving load forecasts from Electric Distribution Companies. Now, PJM is adding an additional step in this load forecasting process. PJM is requiring states to sign off on the EDC load forecasts so that PJM is not held responsible for utility overestimates. I heard the representative from OPSI – Organization of PJM States – mention that his organization is willing to work with PJM on this.

How exactly this would work in practice is still up for discussion because PJM admitted that it had no control over this process since the States would run it. PJM cannot penalize the state. The key question, irrespective of who polices the load forecasts, would be: Is the data center load projection realistic in the EDC load forecast? Is there a duplicative request made of the same data center elsewhere in the same state? Or, what percentage of that load forecast is within a 90-100% confidence interval, for example. Will PJM be able to discern duplicative data center load requests from the same load customer in different states? By incorporating state approval into the load forecasting process, PJM is ensuring fewer PR nightmares down the road.

Price Responsive Demand is on the demand side and Demand Response is on the supply side.

PJM proposes that small incremental changes to existing DR market frameworks are within scope, but wholesale new market changes are outside the scope. There is still some uncertainty here, despite the two-hour discussion on in/out of scope at the October 1 CIFP meeting.

For example, would data center loads have their own ELCC class? We don’t know because it could be beneficial to know how much capacity is credited to meet the data center load, as opposed to the current supply credited towards existing loads.

Some stakeholders are concerned that the current supply is being siphoned off to meet new data center loads, and worry that existing customers are paying for the interconnection of large loads.1 This is a complex area because utility retail rate regulation is outside the scope of PJM’s regulatory mandate.

PJM states that small changes to existing DR products like Price Responsive Demand (PRD) are within the scope of this CIFP process. PRD assumes the customer had tools in place to react to the wholesale PJM market price. What are the current triggers for calling PRD? How does it work on the state’s end? Will this work in conjunction with PJM’s Performance Assessment Intervals? PJM assesses the performance of resources during defined emergency periods. These are referred to as Performance Assessment Intervals, or PAIs. See Source.

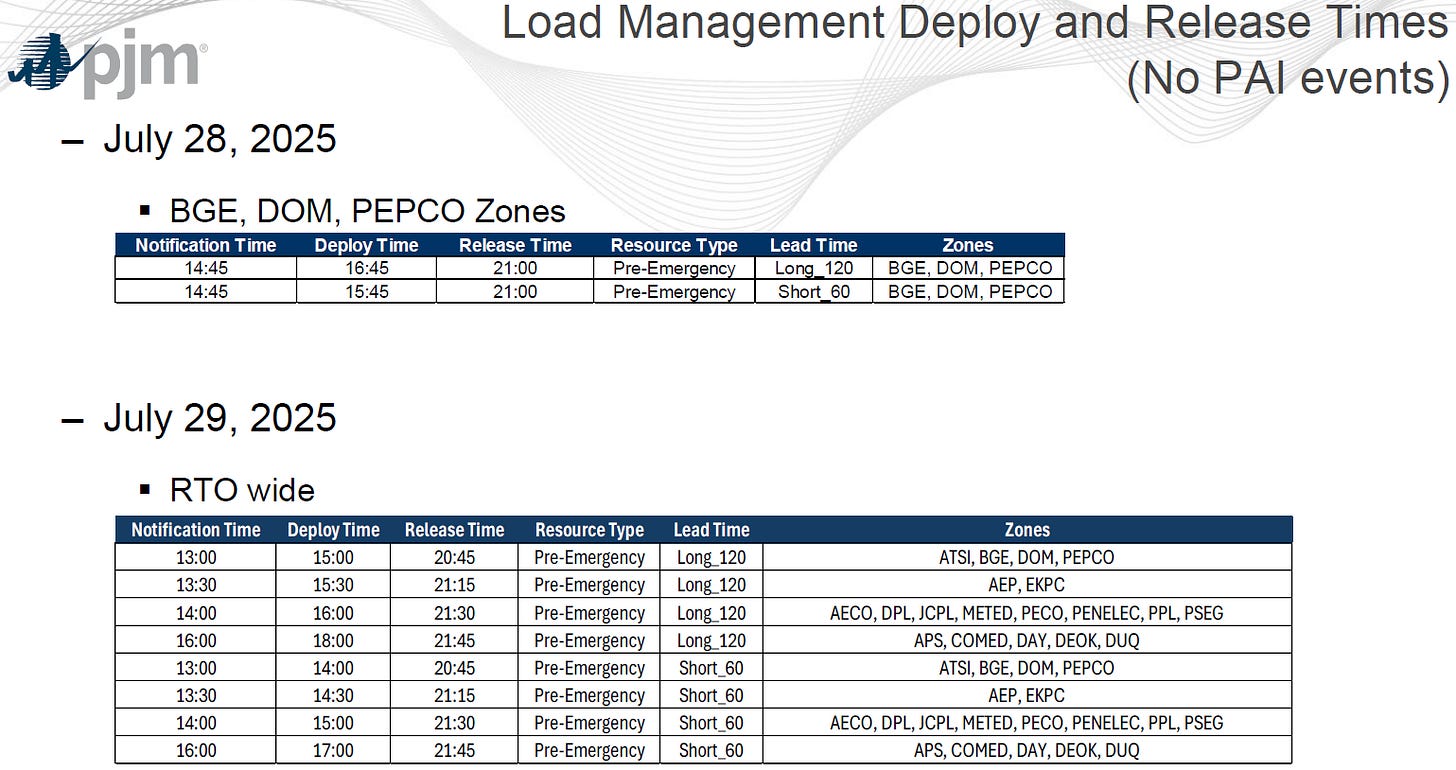

That begs the question, will PJM see a need for long lead time DR or short lead time (less than 30 minutes) DR more in the future when LLAs are interconnected? Because PJM first calls upon long-lead-time DR, which requires more than 60 minutes of notification time, during pre-emergencies, which are EEA1 events. The emergency events are EEA2 events and greater.

Source: PJM

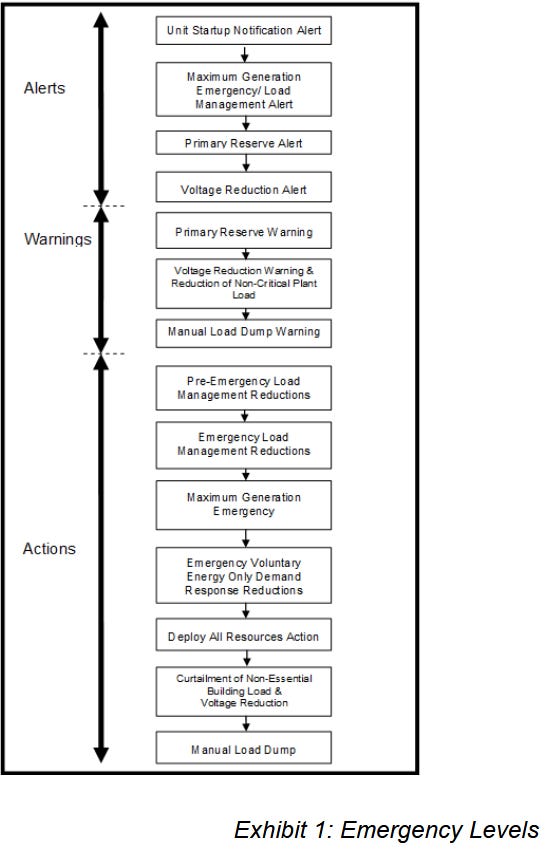

At what step in the PJM Capacity Emergencies order would large loads be curtailed?

Source: PJM Manual 13

The final step is manual load dump2, but that’s done by zone and PJM has no idea which customers would an EDC let go because PJM can only direct its Transmission Owners, not the distribution companies. PJM can only specify the amount of reduction per zone, it is left upto the transmission owner/distribution company how they reduce that load in situations when PJM has to resort to manual load dump which is the last step in PJM’s capacity emergency steps.

Next Steps.

The next CIFP meeting is on October 14th. All of the options discussed at this stage 2 will lead to assembling a solutions package starting in stage 3 at the October 24th meeting. There is another Stage 3 meeting scheduled for November 6th. We are not aware of, nor have we received, written feedback from PJM States regarding their perspective on this LLA effort at the individual state level.

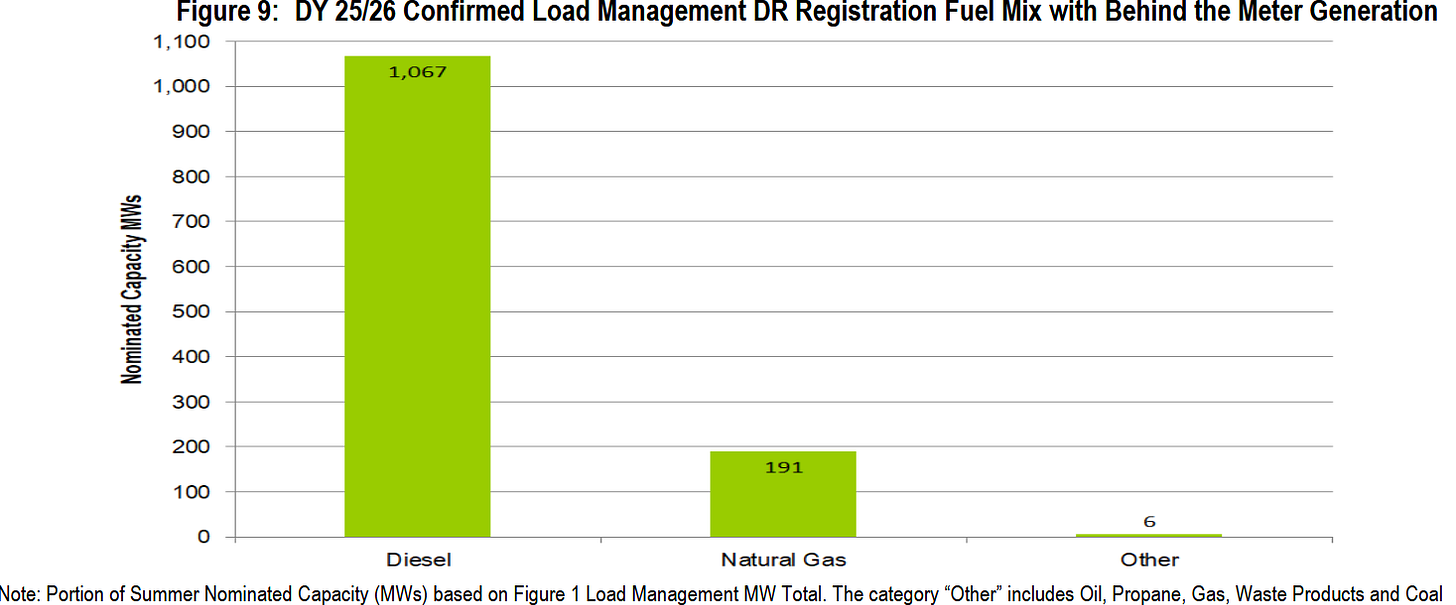

Source: PJM Report

A key question would be whether BTMGs would require air quality permits to operate under EEA1 alerts or only under EEA2 and beyond. Which states have air quality restrictions and how much BTMG capacity is constrained due to environmental limits? Hopefully, we will have the answers to these questions soon, before PJM wraps up the CIFP process.

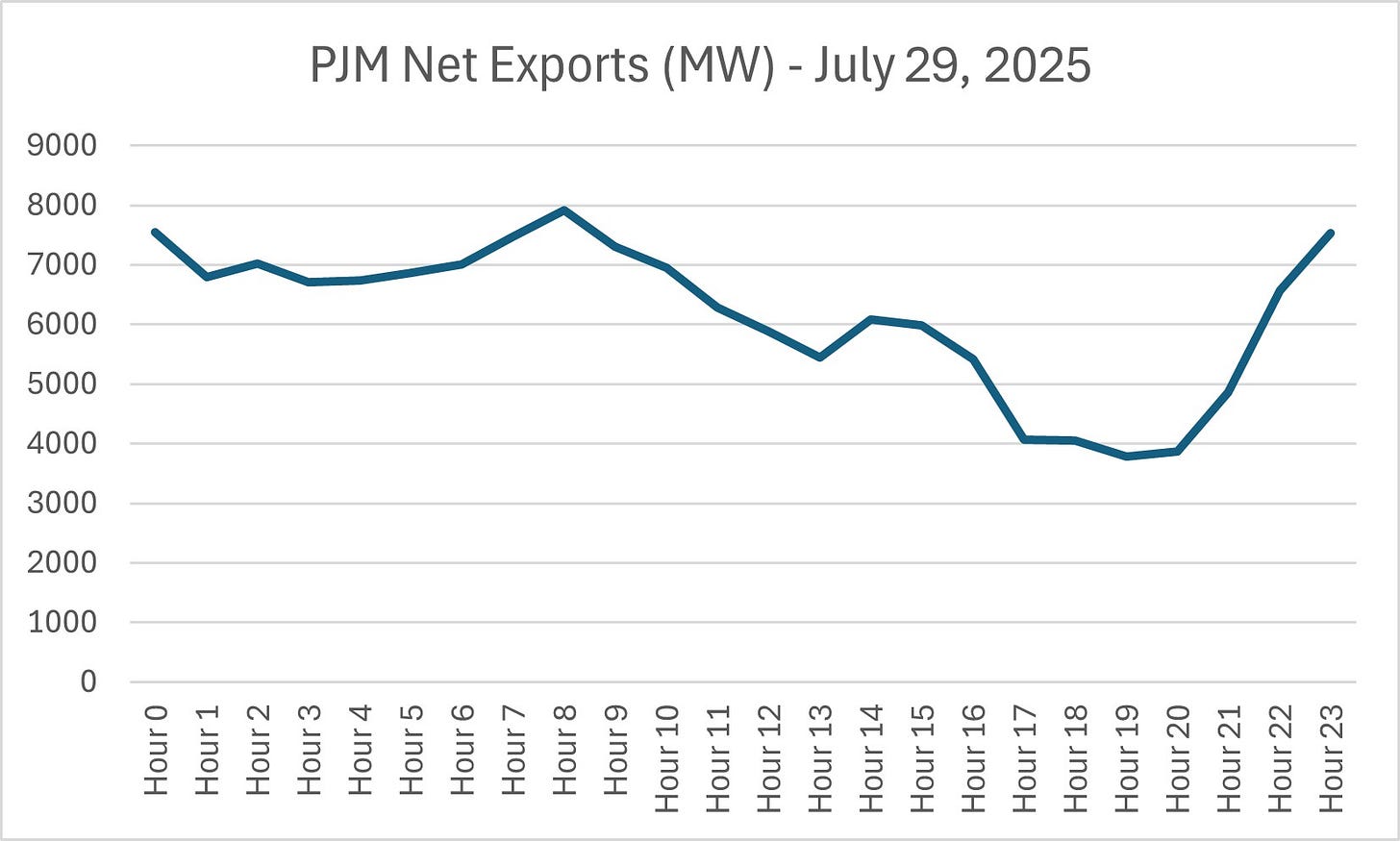

On a final note, what I don’t understand is, on any given day, PJM exports a lot of MWs to its neighbors, and that’s a given, and I am not suggesting PJM should not export – but, why are we not focusing on exports in this large load additions debate? Do we really need to increase our supply while maintaining the current level of exports? Or, can PJM reduce its exports and if so, how much new supply does it need to meet the large loads?

Source: Rao Konidena based on PJM data.

A new report from the Union of Concerned Scientists found that residential customers in seven states that are part of the PJM Interconnection, an electricity market that covers the Mid-Atlantic and parts of the Midwest, are paying nearly $4.4 billion for transmission upgrades intended to deliver electricity to data centers. https://www.ucs.org/about/news/billions-dollars-unreported-data-center-costs-pjm

https://www.pjm.com/-/media/DotCom/committees-groups/cifp-lla/2025/20250902/20250902-item-03---large-load-additions-pre-cifp-education---pjm-presentation.pdf